Who We Are

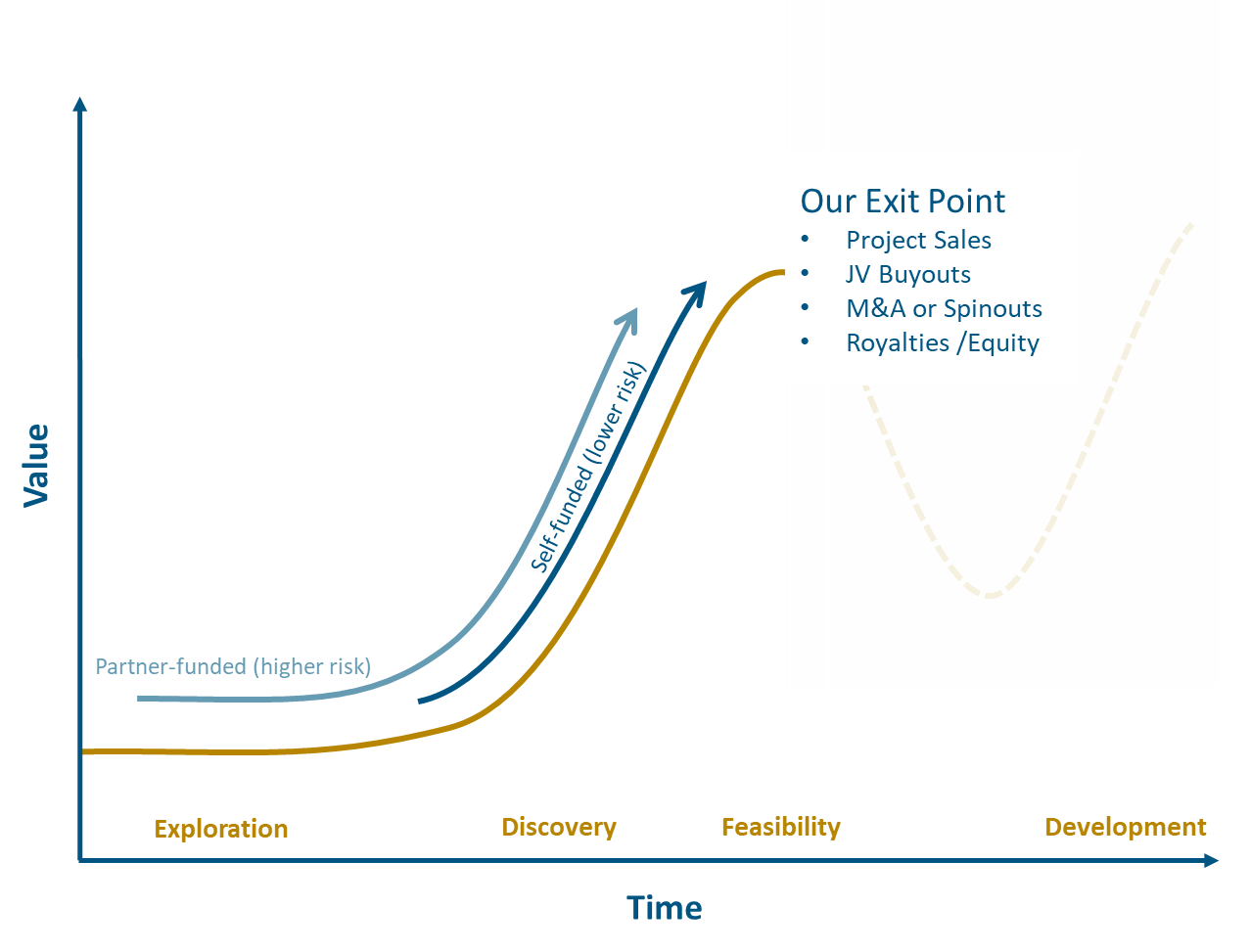

Targeting the Steepest Part of the Curve

We are a mineral exploration and development company advancing a pipeline of high-quality assets. Our business model is aimed at maximizing value creation at the steepest part of the Lassonde Curve—the discovery and early-development stages—while managing risk and capital efficiency.

As projects advance through discovery, resource definition, and early technical studies, their value increases sharply. Rather than carrying them through to production, which requires significant capital and long timelines, we look to monetize at the optimal value inflection point through project sales, JV buyouts, M&A or spinouts, retained royalties or equity. This approach allows us to capture maximum value without taking on development risk, and to recycle capital into the next wave of discovery and early-stage growth.

Our goal is to build value and realize it when market interest and asset potential are both at their peak.

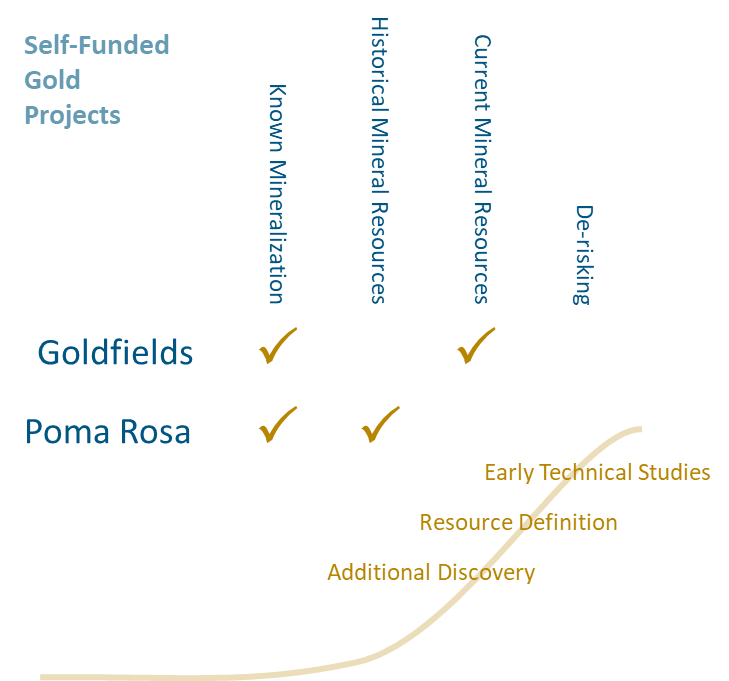

Selective Project Advancement

We strategically self-fund key exploration and development stage assets with near-term upside potential and limited downside risk. These projects typically have known mineralization or resources and can be quickly advanced through additional discovery, resource definition and early technical studies. By maintaining full control, we capture the greatest share of value as these assets move up the curve.

Project Generation & Partnerships

To unlock the blue-sky potential of early-stage exploration projects, we generate and acquire high-quality projects at low cost and then seek strong partners to fund advancement through higher risk grassroots exploration. This limits dilution, and retains long-term upside through royalties, equity, or carried interests. This strategy reflects our entrepreneurial spirit and opportunistic mindset and is underpinned by our deep technical expertise in geology and exploration models.

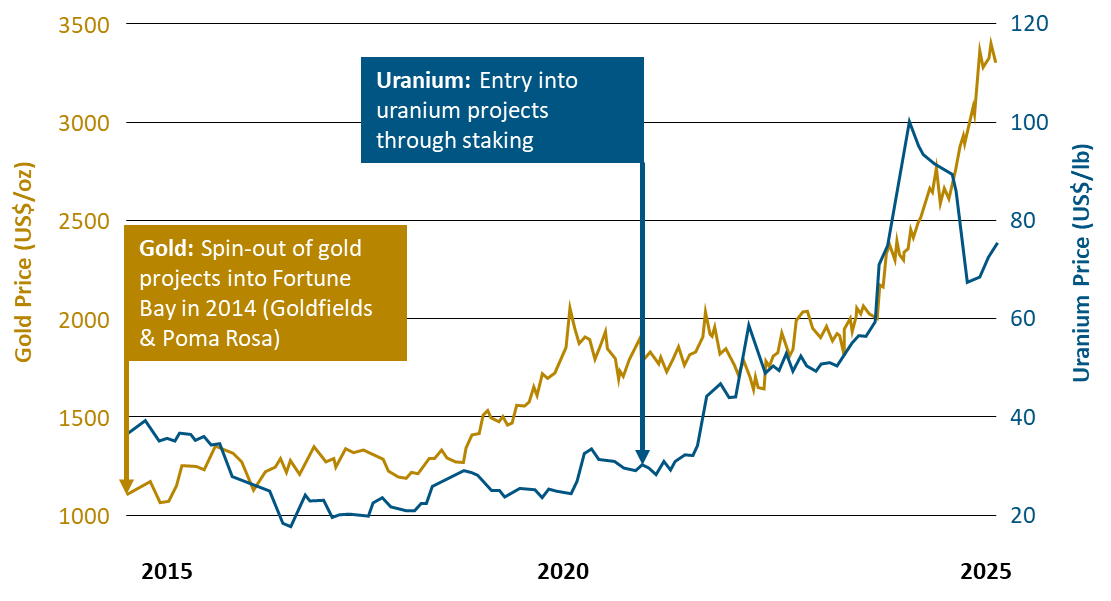

Timing Matters

Adopting a Cycle-Aware Strategy and taking long-term value driven approach, we aim to identify strategic entry points into commodities poised for upward revaluation. Through Value Window Optimization, we align our spending and exploration or development intensity with our understanding of the commodity cycle—aiming to minimize dilution and maximize shareholder returns.

Our continued focus on gold (Goldfields and Poma Rosa Projects) reflects its persistent role as a hard asset in volatile financial markets, particularly during inflationary or geopolitical stress.

Our entry into uranium (Murmac & Strike, and The Woods Projects) was driven by a long-range thesis around nuclear energy’s role in decarbonization and the structural underinvestment in new supply.

We don’t chase heat—we anticipate it. Our goal is to build and position assets before momentum arrives, unlocking maximum value as capital returns to the sector.

Our Vision

To be a trusted, efficient, and forward-thinking exploration company— driving discovery and development of mineral resources while creating long-term shareholder value.